Ongoing cost of living pressures mean that employees are struggling—and paying closer attention than ever to how they are supported financially by their employers. In fact, according to recent research employees are now rating their personal finances as equally important as their mental health.1 Optimising your benefits with potential tax savings through salary packaging could deliver immediate relief for your workforce.

Households are feeling the pinch

Times have been tough on the Australian household for some time now: the rate of inflation has been elevated for two years, and employee households in particular are doing it tough, with another 6.5% rise in living costs in the past 12 months.2 Transportation costs alone now account for 17% of the average Australian household’s income, after costs increased by more than three times the national inflation rate in 20233. The rental crisis continues unabated, and interest rates are at a 12 year high, with half of homeowners (52.5%) suffering from mortgage stress.4 All of this has resulted in a record half of all Australians nationally now reporting elevated cost-of-living and personal debt distress (50%).5

Helping deliver financial relief through untapped benefits

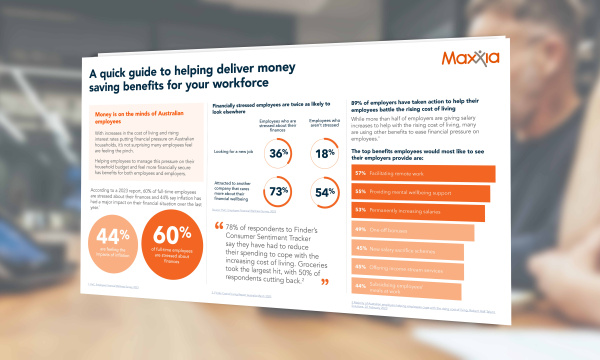

The bottom line is that Australians are looking to improve their financial situation. And savvy employers are exploring ways to meet this need through their employee benefits program. While employees rework household budgets and keep spending to bare essentials, many employers are discovering the potential unrealised financial value of salary packaging. A recent study from recruiter Robert Half reveals that an overwhelming number of employers (89%) have implemented measures to help employees cope with escalating financial stress6. A comprehensive salary packaging program could be a cost-efficient way for employers to improve financial wellbeing, and can include a combination of the following:

At Maxxia we’re proud to be helping our clients’ employees with combined anticipated tax savings of approximately $155M^ for the six months until end of June 2023.

Novated leasing

A novated car lease is not a new concept but it could be a great way to save money on GST and some running costs. Nearly all purchase and running costs for a vehicle are budgeted and bundled into a single monthly payment deducted from an employee’s pre-tax salary that can include:

- Annual registration costs

- Insurance

- Repairs and maintenance

- Petrol

- Car washes

With a novated lease, employees could free up their disposable income and leverage Maxxia’s novated leasing expertise for better deals on preferred new or used vehicles and trade-ins.

The rEVolutionary way to help employees save money

The EV Discount ramps up potential tax savings for employees when they take up an EV novated lease. Find out more in our guide to the EV Discount for HR professionals.

Professional development and technology

With the job market changing at pace amid AI developments and industry demand for both hard and soft skills, keeping up-to-date with technology and progressing professional development is vital. Upskilling and having access to the latest computers and mobile devices is another salary packaging option. It works like novated leasing, with payments deducted from pre-tax salary for professional memberships, self-education, laptops, and tablets. This means employees may have more take home pay each pay day and don’t have to wait until the end of the financial year to realise tax savings.

Expanded salary packaging options

Salary packaging can offer even broader benefits depending on your organisation’s industry. For example, in the healthcare, charity, and not-for-profit sectors employees may be able to salary package household living expenses, school fees, meals and entertainment. Employees in the charity sector, for example, could benefit from up to $5,849* in potential tax savings every year.

Regardless of the salary packaging options your employees choose, employee benefits programs can be a compelling way to provide financial uplift for your workforce. It also forms part of a superior employee value proposition (EVP) that can help attract and retain the best talent.

Discover how much your employees could be saving in tax dollars with our HR benefits program calculator.

1. Gallagher, Workforce Trends Report, May 2024

2. Australian Bureau of Statistics, Selected Living Cost Indexes, March 2024

3. Australian Automobile Association, Transport Affordability Index Q1 2024

4. Aussie, New Aussie Data Reveals the Cost-of-Living Crunch, May 2024

5. Suicide Prevention Australia, Community Tracker, March 2024

^Figures based on 1 January 2023 to 30 June 2023. The combined anticipated tax saving is an estimate only and is based on a) end-of-lease sales during that 6-month period and b) the average potential tax saving per employee. The average potential tax saving per employee is based on a) the estimated payroll tax savings of those employees over the life of the lease (having regard to their actual salary, lease term and budgeted pre-tax deductions over the life of the lease), b) the one-off dealer discounts applied at the point of sale and c) the GST that would have been payable upfront on the cost of the car. Refunds for Input Tax Credits have also been taken into account where relevant.

^For novated leases settled between 1 January 2023 to 30 June 2023.

*This calculation is based on a sample of existing Maxxia clients. Benchmark employee participation levels, the average income and the average spend per benefit for each sector are used. Maxxia does not accept responsibility for any loss or damage that may relate to a person's use of, or reliance on, this calculator. Users should consider their organisation's specific circumstances. Contact Maxxia directly for more information.