With increases in the cost of living and rising interest rates putting financial pressure on Australian households, it’s not surprising many employees feel like a return to the office is an expensive option. Particularly when you consider employees around the world – including Australia – were saving on average AUD$10,000 a year when working from home.1

According to recent research, 4 in 5 (83%) Australians say they have set financial goals for 2023. Saving more (50%) and spending less (32%) is top of mind for most, and 1 in 5 (18%) are hoping to reduce their everyday expenses.2

The good news is HR teams can help employees ease the ‘cost of working’ so that financial considerations don’t become an obstacle to spending time in the office. Read on to discover 5 ways you can reduce the financial pinch of coming into the office.

1. Harness the power of a free lunch

Nearly 1 in 4 employees (23%) reported that they would return to the office full-time if free, catered lunches were available.3 It makes sense when you consider buying lunch everyday could cost as much as $60 a week or $3,000 per year.4 For those commuting to the office part of the time, 65% of survey participants shared that they would plan to work on site based on complimentary lunches offered.5

While it would be great to make free lunches happen, the location and size of your workforce could make it impractical to offer free or subsidised meals to all employees. As a more affordable option, the humble fruit bowl can be a good way to keep employees fuelled through their working day.

A free vending machine stocked with healthy options can be even more convenient and easier to manage. While not a lunch or breakfast replacement these extras can offer an accessible alternative to buying or bringing snacks from home.

Employees in the healthcare and charity sectors could save when dining out with family and friends

Meal Entertainment covers restaurant bills when an eligible employee dines out with others. It does not cover take-away meals or eating alone. The easiest way to salary package Meal Entertainment expenses is to use the Maxxia Wallet card. It works the same way as a debit card – except the funds are drawn from an employees’ salary packaging account.

2. Help employees save money on running their car with a novated lease

Of the 28,000 workers who took part in a Cisco survey, 86% ranked fuel and commuting costs in their top three areas for saving during the pandemic.6 Another study showed that almost 7 in 10 Australian workers (68%) said they think their employers should help them offset the cost of travelling to the office by increasing salaries or providing a fuel allowance.7

For employees who are driving to work again, rising fuel costs have increased the burden of commuting on their household budget. A salary packaging arrangement for their vehicle can bundle running costs – such as fuel and servicing – as well as the lease price of their vehicle and is available on new, used and even existing cars.

Maxxia can source a vehicle, negotiate a great price, manage the paperwork, and arrange finance and insurance. Calculate potential savings using the Maxxia novated leasing calculator.

3. Make wellbeing part of the workplace

Exercise can support employees physical and mental wellbeing, but the daily commute can eat into time used to workout. A gym that’s local to an employees workplace can be the most convenient way to keep a fitness habit going. Many gyms offer corporate packages, enabling employers to offer employees a discount on their gym membership without having to foot the bill or subsidise their fee.

Those who work in the healthcare sector (46%) and education (42%) find company initiatives like subsidised counselling, mental health days and meditation and yoga, to be especially important.8

4. Offer discounts on lifestyle items through rewards

Helping employees out with the cost of living doesn’t have to be limited to saving them money on their days in the office. A well designed rewards program can help save on many lifestyle costs – from shopping and entertainment to holidays and travel.

Depending on the sector, employees may be able to salary package lifestyle expenses up to a certain threshold. Our salary packaging calculator can help you find out how much employees in your industry can expect to save on their tax with salary packaged benefits and rewards.

5. Support for employees struggling with financial stress

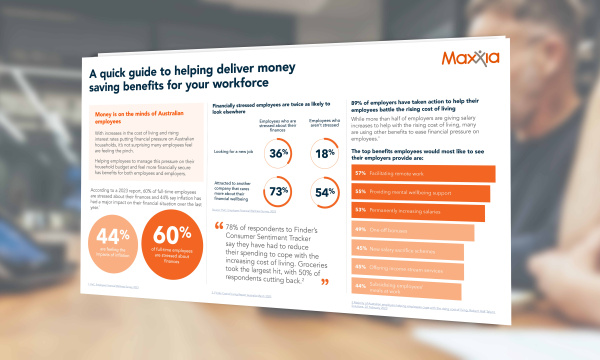

In 2022, almost 1 million workers were severely financially stressed and more than 2 million were moderately financially stressed.9 Helping employees manage changes in their expenses with less stress can be an important way to foster financial wellbeing. By providing access to financial coaching and benefits education, EAPs can help your employees feel more confident about the spending choices they’re making and plan for a more secure financial future. EAPs often go unrecognised as a key part of an effective financial wellbeing program for your workforce.

Our quick guide for HR leaders shares five key steps to help employers get the most from their investment in financial wellbeing.

As a premium provider of employees benefits to many organisations across Australia, Maxxia have seen the difference salary packaging can make to the overall financial position of employees. Watch this short video to find out more.

Maxxia can offer your organisation a complimentary benefits assessment to measure the effectiveness of your current employee benefits offer. We can also put a dollar figure to the potential savings and efficiencies from running the program and compare overall performance with best practice for your industry.

1 & 6. Cisco, Global Hybrid Work Study, 2022

2. Finder, Saving and slimming: over 14 million Aussies have a resolution for 2023, January 2023

3 & 5. Forbes, The power of free lunch, July 2022

8. Employment Hero, Insights Report What Australia employees want from their workplace, 2022