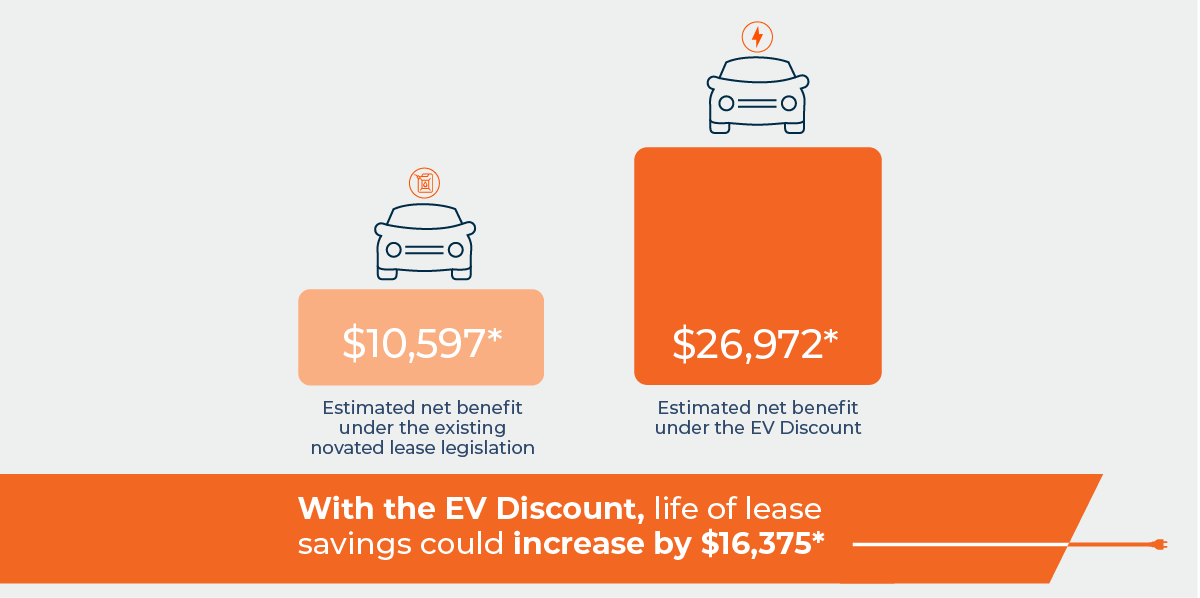

Research shows 9 in 10 employers have taken action in their organisation to support employees with the rising cost of living.1 Employees could save thousands of dollars with the EV Discount by making the switch to a low or zero-emission vehicle for their novated lease. The new EV Discount ramps up potential tax savings for employees because a novated lease on an eligible electric vehicle (EV) is FBT exempt, meaning employees may not need to pay any post-tax contributions.

The EV market is evolving rapidly and with enquiries about novated leases for EVs rising, here are 5 facts HR need to know about EVs.

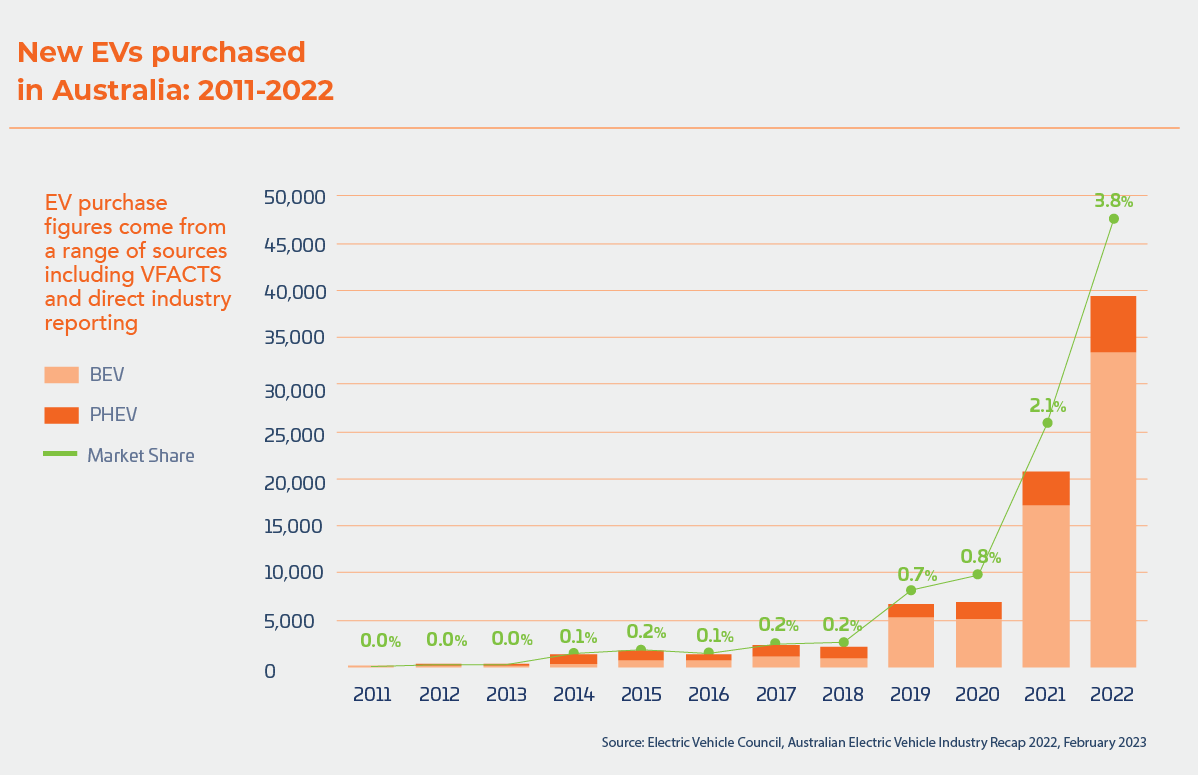

1. Australia is heading towards an all electric vehicle future

The number of EVs in Australia is forecast to tick over to 100,000 sometime in 2023 – even bigger growth than forecast in 2022.2

Car maker Jaguar predicts two-thirds of Australians will be driving EVs by 2028.3

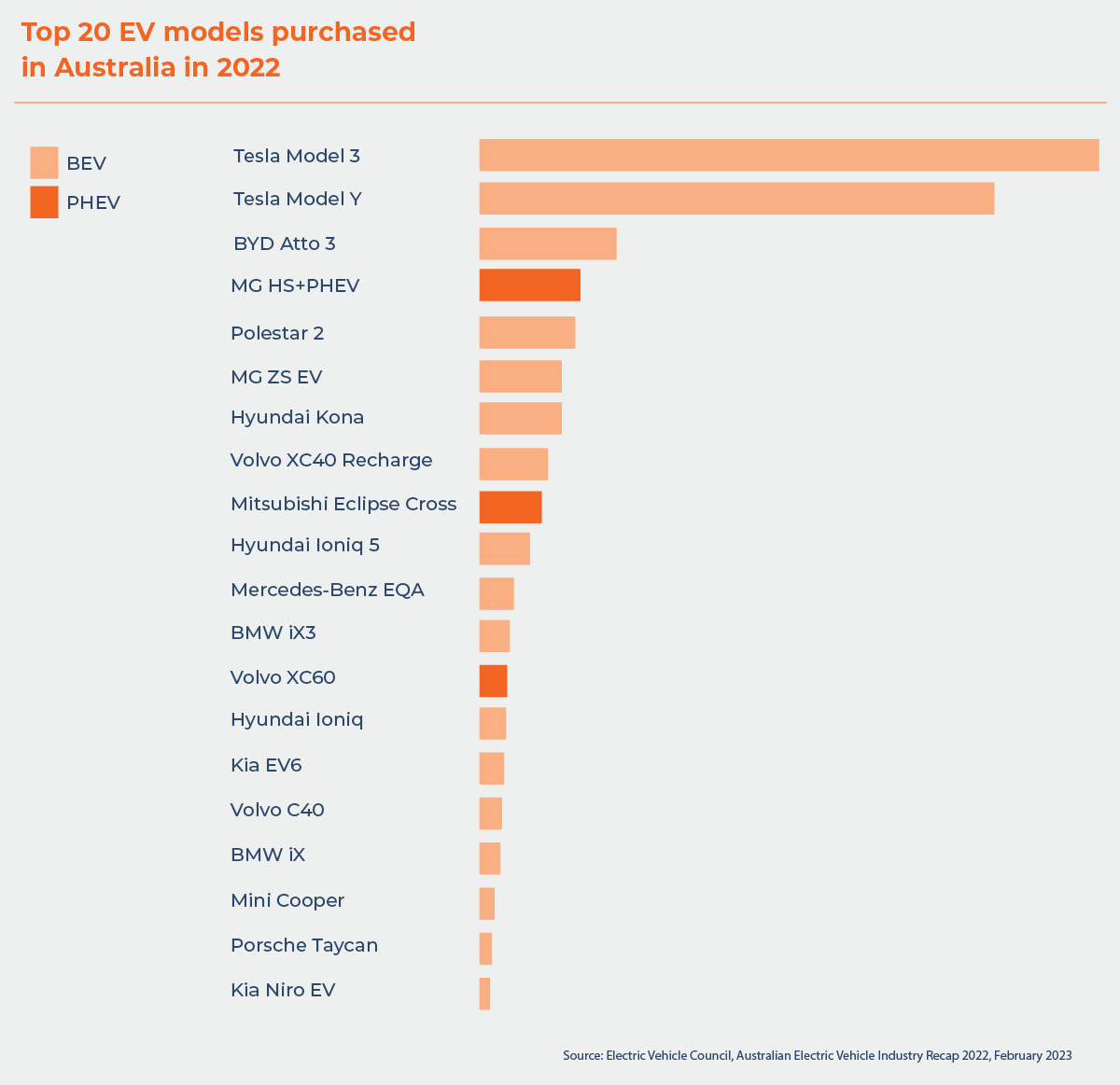

2. Choice is growing for electric vehicles in Australia

45 EV models were available in Australia in 2022, with 95 variants.4 In the 2024-2025 financial year, EVs retailing up to the Luxury Car Tax threshold of $91,387 may be eligible for the EV Discount.

In 2023, around 30 new EV models are set to hit the market increasing choice for potential buyers.5

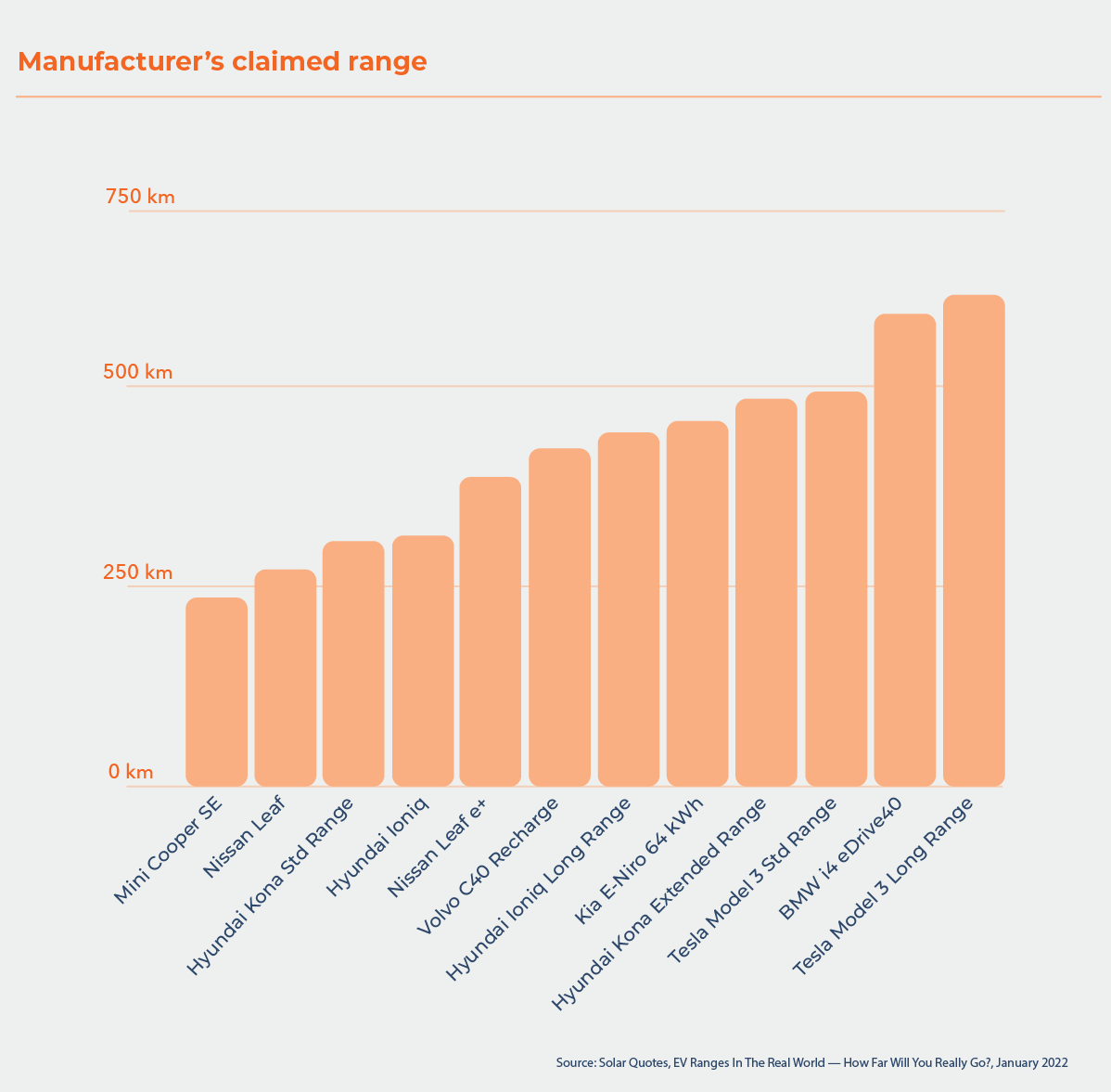

3. Range anxiety is becoming a thing of the past

The average battery range for an EV is now 480km.6

The chart below shows the EV ranges provided by manufacturers.

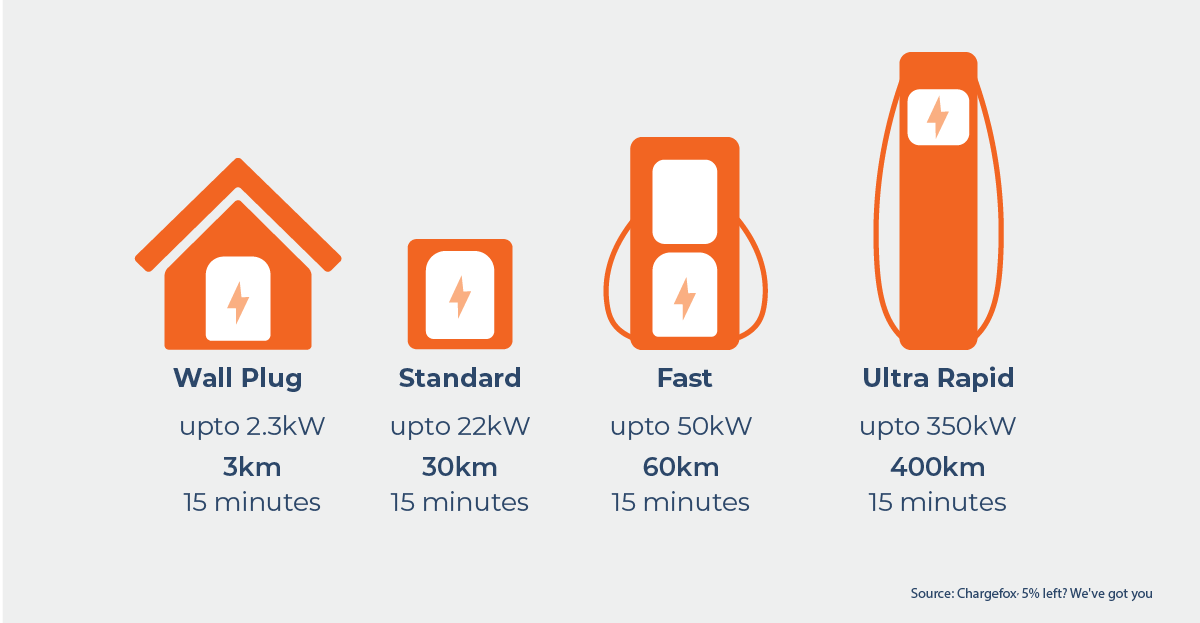

4. Charging is getting quicker and easier

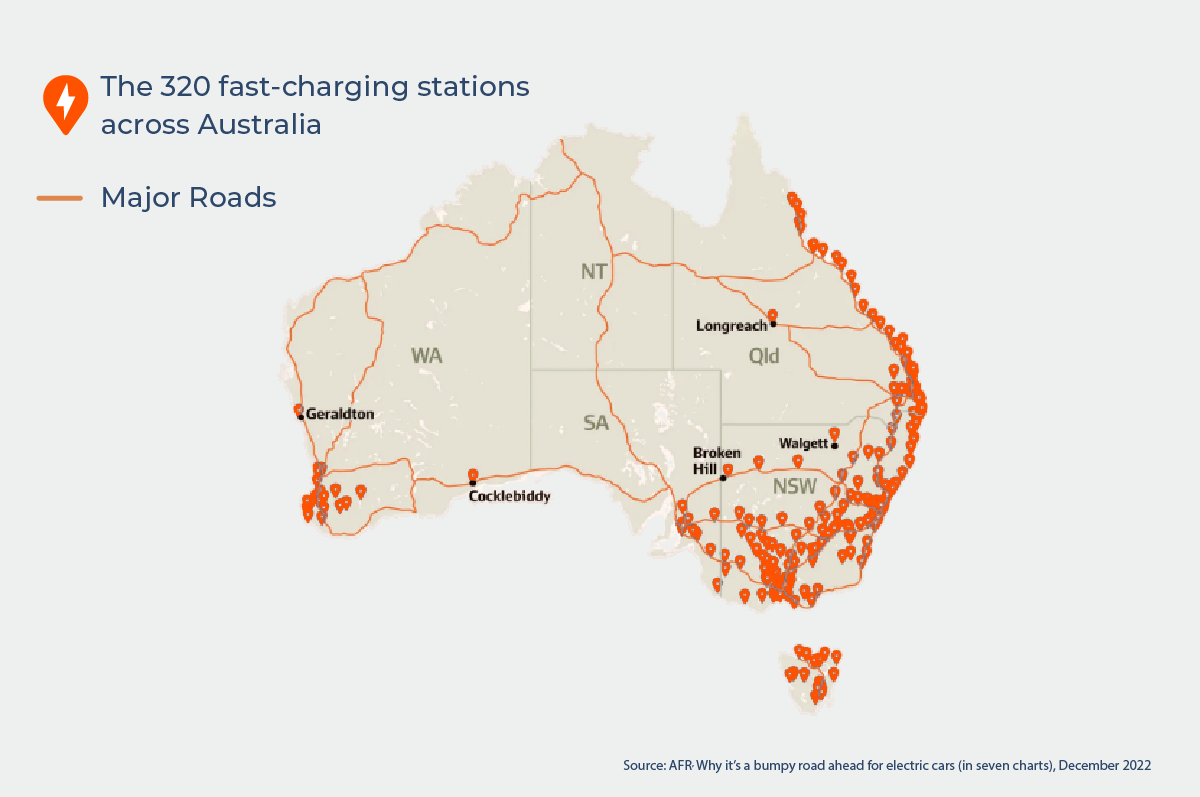

As at December 2022, Australia had a total of 2,286 individual listed public charging locations of which 320 are fast charging stations.7

The majority of EVs support DC fast charging which allows a car to charge in minutes instead of hours.8

5. Affordability for employees just got a huge boost

Around 74% of Australians say they expect to cut back on spending this year thanks to the rising cost of living.9 Employees could be saving thousands on their next vehicle with the EV Discount.

It’s a great time to introduce your employees to the EV Discount

Get valuable insights on how to take advantage of the EV Discount and help employees save money while contributing to a more sustainable future for Australia.

Maxxia can offer your organisation a full benefits assessment to measure the effectiveness of your current employee benefits offer. We can also put a dollar figure to the potential savings and efficiencies from running the program and compare overall performance with best practice for your industry.

*Assumptions: The estimated potential tax benefit is exclusive of GST and is based on the assumption that you would have paid for the lease from your post tax salary (as opposed to salary packaging those payments from your pre-tax salary or a combination of your pre and post-tax salary). Payments include: Your car payments, fuel (not applicable to EVs), registration, tyres, insurance and scheduled servicing. The estimated annual benefit will vary depending upon salary, employment circumstances, selected benefits and applicable tax treatment. The example assumes you earn $80,000 a year, a 5-year lease term, an annual distance travelled of 20,000kms and a 28.13% residual value. The estimated annual operating costs includes estimates of fuel (not applicable to EVs), maintenance, tyres, registration, comprehensive insurance and fleet management fee and are exclusive of GST. GST of 1/11th is payable on your ECM contributions. State Stamp Duty rates apply. PAYG tax rates effective 1 July 2020 have been used.

3. WhichCar, New Electric Cars for Australia: Everything coming in 2023 and beyond, February 2023

4. Electric Vehicle Council, State of Electric Vehicles Report, 2022

5 & 7. AFR, Why it’s a bumpy road ahead for electric cars (in seven charts), December 2022

6. Solar Quotes, EV Ranges In The Real World — How Far Will You Really Go?, January 2022